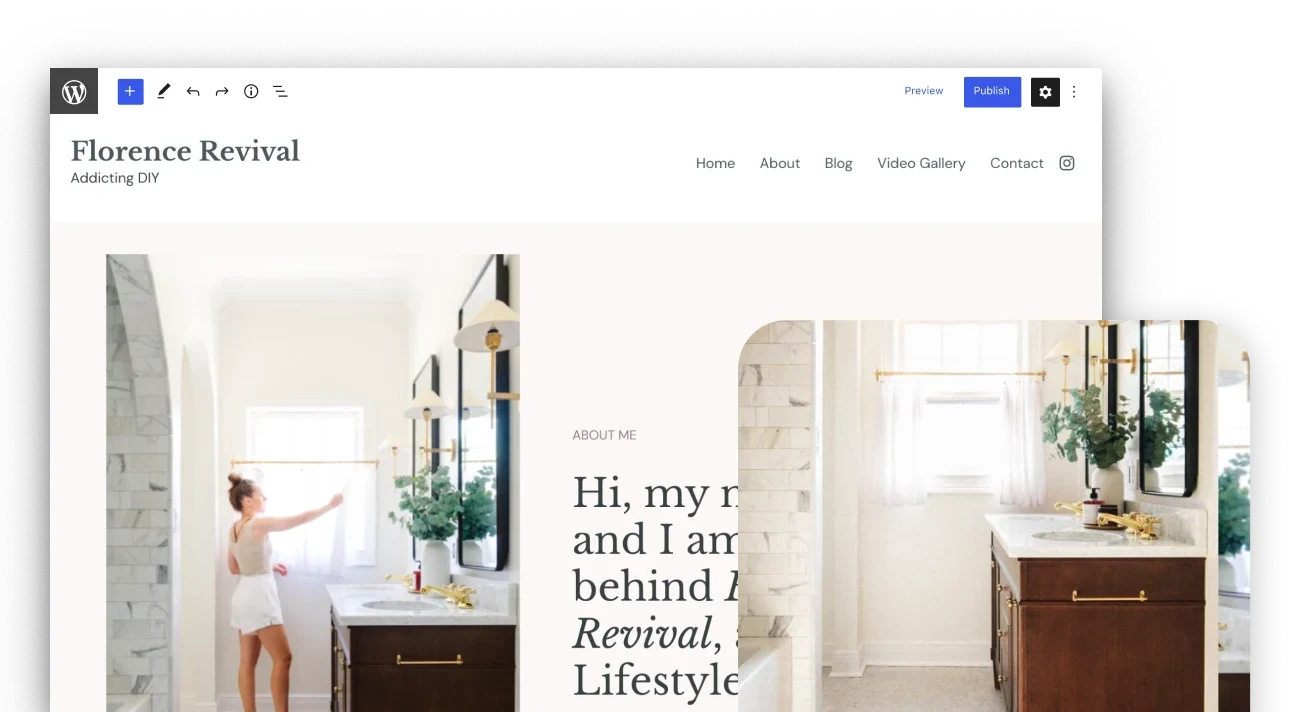

WordPress, Your Way

Build and grow your website with the best way to WordPress. Lightning-fast hosting, intuitive, flexible editing, and everything you need to grow your site and audience, baked right in.

The best way to WordPress—intuitive editing, lightning-fast hosting, and everything you need to grow your site and audience, baked in.

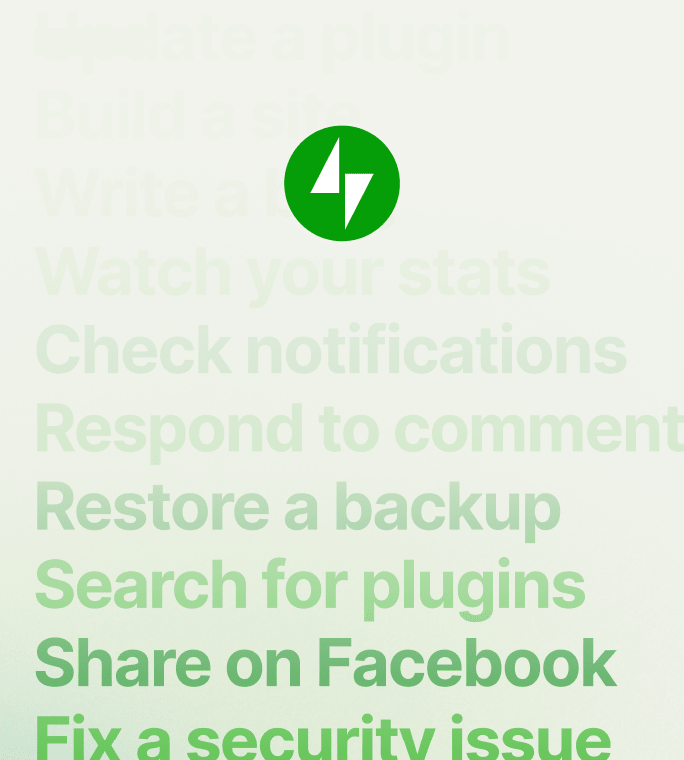

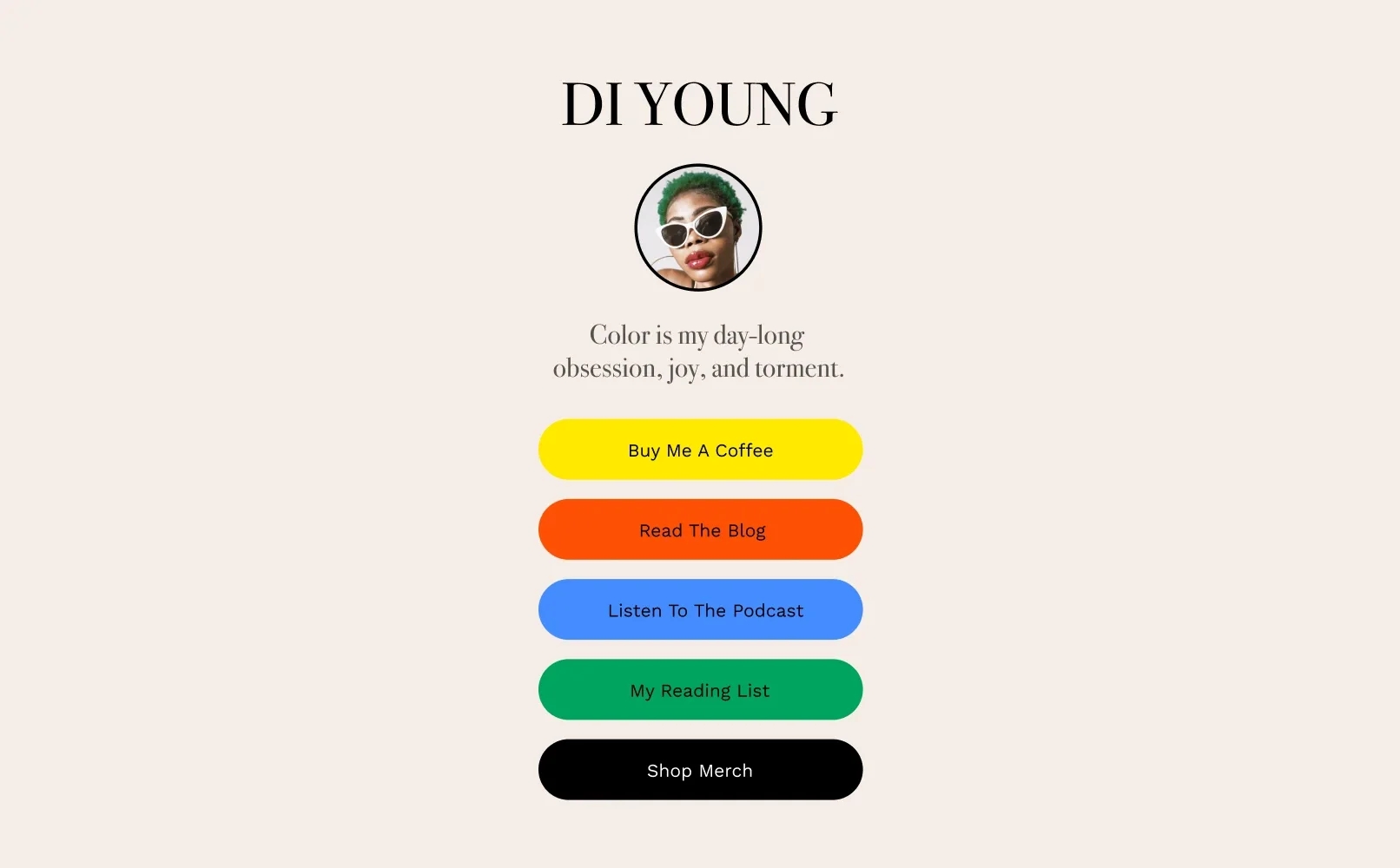

Do it all with

WordPress.com

Write, share, and reach an audience. Link, sell, and showcase your work. Anything, everything—all in one place.

Claim your home on the web

Grab the perfect domain—with or without a website—for an unbeatable price. The popular .com, .org, and .net extensions start at just per year. Easy to remember, easy to share, and sure to stand out.

Host with the best

When you create a site with WordPress.com, you get all of the power of lightning-fast, secure managed WordPress hosting.

Room to grow

Scale as you go with unmetered bandwidth on all plans. Zero downtime.

No limits.

Seriously secure

Firewalls, encryption, brute force, and DDoS protection. Security’s all taken care of.

Bring it with you

Fast data transfer and performance come as standard with our global CDN—wherever your site visitors are.

Flexible storage

You’ll never run out of storage with WordPress.com’s plans. Photos. Audio. 4K videos. All in one place.

There’s a plan for you

Choose a plan today and unlock a powerful bundle of features. Or start with our free plan.

WordPress.com Plans

Starter

Storage

6 GB- Free domain for one year Free domain for one year Get a custom domain – like yourgroovydomain.com – free for the first year.

- Access to dozens of premium themes Access to dozens of premium themes Switch between all of our Starter design themes.

- Ad-free experience Ad-free experience Unlock a clean, ad-free browsing experience for your visitors.

- Extremely fast DNS with SSL Extremely fast DNS with SSL Tap into fast, reliable domain management with secure SSL.

- Support via email Support via email Fast, friendly, expert WordPress help, whenever you need it.

- 8% transaction fee for payments (+ standard processing fee) 8% transaction fee for payments (+ standard processing fee) Credit card fees are applied in addition to commission fees for payments.

- Security, performance, and growth tools—powered by Jetpack.

Storage

6 GBExplorer

Storage

13 GB- Everything in Starter, plus:

- Free domain for one year Free domain for one year Get a custom domain – like yourgroovydomain.com – free for the first year.

- Live chat support Live chat support Realtime help and guidance from professional WordPress experts.

- Access to all premium themes Access to all premium themes Switch between a collection of premium design themes.

- Earn with WordAds Earn with WordAds Display ads and earn from premium networks via the WordAds program.

- Customize fonts and colors Customize fonts and colors Take control of every font, color, and detail of your site’s design.

- 4% transaction fee for payments (+ standard processing fee) 4% transaction fee for payments (+ standard processing fee) Credit card fees are applied in addition to commission fees for payments.

- Upload 4K videos with VideoPress Upload 4K videos with VideoPress Showcase your video beautifully with the 4K VideoPress player.

- Unlimited automatic shares in social media Unlimited automatic shares in social media Share your latest posts to your social channels, without limits.

- Site activity log Site activity log Keep an administrative eye on activity across your site.

- In-depth site analytics dashboard In-depth site analytics dashboard Deep-dive analytics and conversion data to help you make decisions to grow your site.

- Security, performance, and growth tools—powered by Jetpack.

Storage

13 GBCreator

Storage

- Everything in Explorer, plus:

- Free domain for one year Free domain for one year Get a custom domain – like yourgroovydomain.com – free for the first year.

- Install plugins and themes Install plugins and themes Unlock access to 50,000+ plugins, design templates, and integrations.

- Unrestricted bandwidth Unrestricted bandwidth Never fret about getting too much traffic or paying overage charges.

- No limitations on site visitors No limitations on site visitors Grow your site traffic without worrying about limitations.

- 24/7 expert support 24/7 expert support Fast, friendly, expert WordPress help, whenever you need it.

- Global edge caching Global edge caching Ensure your cached content is always served from the data center closest to your site visitor.

- High-burst capacity High-burst capacity Lean on integrated resource management and instant scaling.

- Web application firewall (WAF) Web application firewall (WAF) Block out malicious activity like SQL injection and XSS attacks.

- Global CDN with 28+ locations Global CDN with 28+ locations Rely on ultra-fast site speeds, just about anywhere on Earth.

- High-frequency CPUs High-frequency CPUs Get the extra site performance of high-frequency CPUs, as standard.

- Automated datacenter failover Automated datacenter failover Count on your site being replicated in real-time to a second data center.

- Isolated site infrastructure Isolated site infrastructure Rest easy knowing that your site is isolated from others for added security and performance.

- Managed malware protection Managed malware protection Stay safe with automated malware scanning and one-click fixes.

- Tiered storage plans available Tiered storage plans available Find the storage plan that works for your site’s needs.

- Real-time security scans Real-time security scans Our dedicated security team works round-the-clock to identify and combat vulnerabilities so that you don’t have to.

- Spam protection with Akismet Spam protection with Akismet Never worry about spam with Akismet, which is included at no additional cost.

- DDoS protection and mitigation DDoS protection and mitigation Breeze past DDoS attacks thanks to real time monitoring and mitigation.

- SFTP/SSH, WP-CLI, Git tools SFTP/SSH, WP-CLI, Git tools Use familiar developer tools to manage and deploy your site.

- Free staging site Free staging site Test product and design changes in a staging site.

- Seamless staging and production syncing Seamless staging and production syncing Iterate faster and deploy confidently by synchronizing staging and production environments in a few short steps.

- Automated WordPress updates Automated WordPress updates Get every WordPress update. And every patch. Automatically.

- Centralized site management Centralized site management Seamlessly switch between 2, 20, or 200 sites. All from one place.

- Vulnerability notifications for core and plugins Vulnerability notifications for core and plugins Stress less knowing there’s a dedicated team identifying potential vulnerabilities for WordPress and plugins, ensuring early detection and preventing future attacks.

- 0% transaction fee for standard WooCommerce payment features (+ standard processing fee) 0% transaction fee for standard WooCommerce payment features (+ standard processing fee) Credit card fees are applied in addition to commission fees for payments.

- 2% transaction fee for standard payments (+ standard processing fee) 2% transaction fee for standard payments (+ standard processing fee) Credit card fees are applied in addition to commission fees for payments.

- Real-time backups Real-time backups Count on multi-redundancy, real-time backups of all your data.

- One-click restores One-click restores Revert back to a point-in-time in your site’s history, with a single click.

- Uptime monitor Uptime monitor Stay up-to-date with continuous uptime monitoring, with alerts the minute downtime is detected.

- Built-in Elasticsearch Built-in Elasticsearch Make surfacing your content simple with built-in premium site search.

- Plugin auto-updates Plugin auto-updates Forget about time-consuming plugin updates and update nags.

- SEO and analytics tools SEO and analytics tools Rank well in search with built-in search engine optimization tools.

- Security, performance, and growth tools—powered by Jetpack.

Storage

Entrepreneur

Storage

- Everything in Creator, plus:

- Free domain for one year Free domain for one year Get a custom domain – like yourgroovydomain.com – free for the first year.

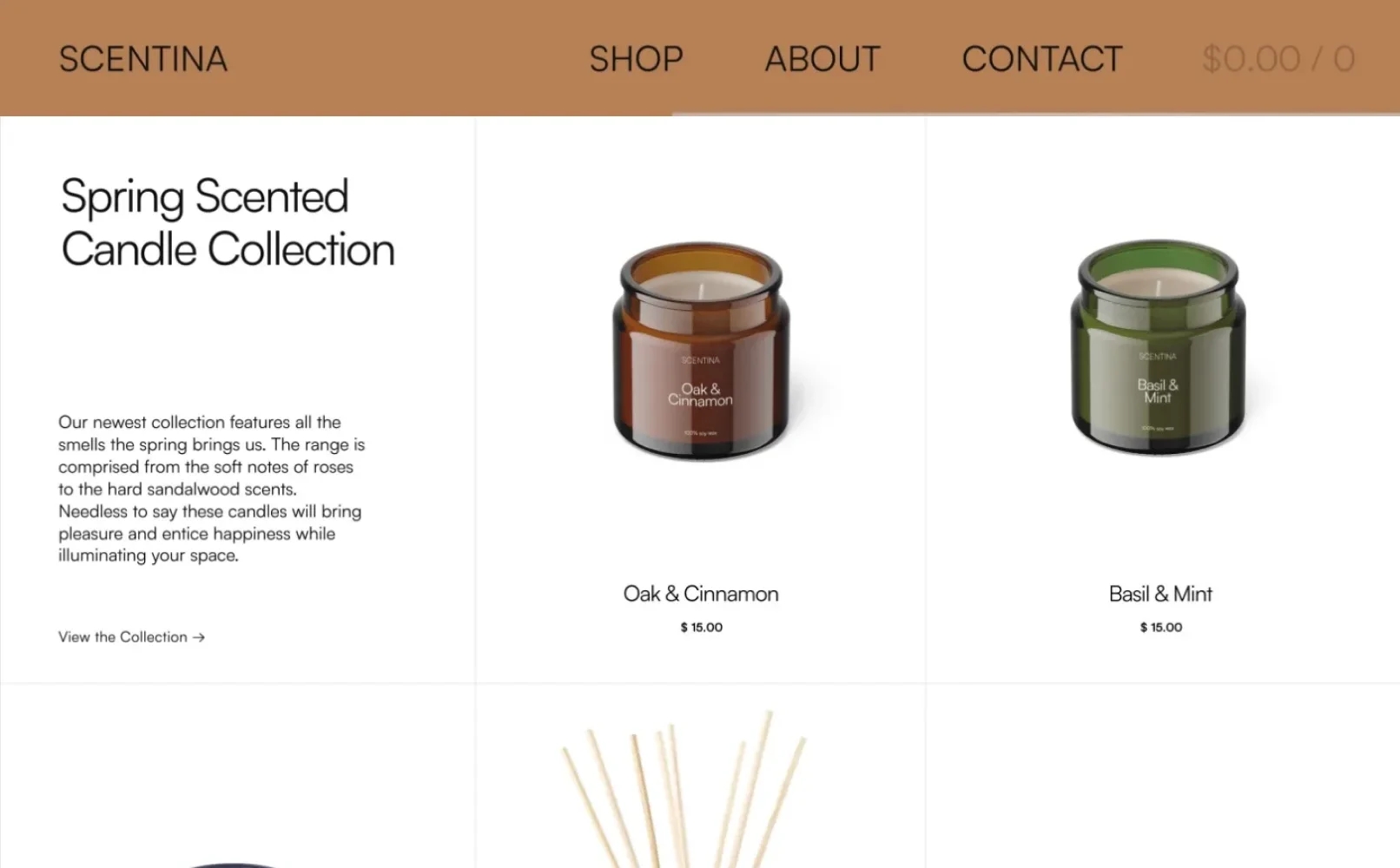

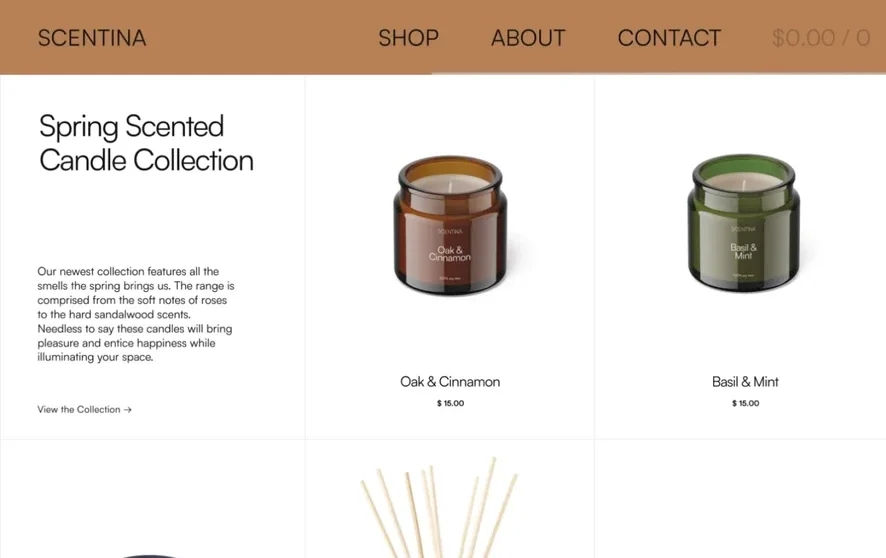

- Optimized WooCommerce hosting Optimized WooCommerce hosting Enjoy a hosting solution tailored to enhance the performance and security of sites running WooCommerce.

- Premium store themes Premium store themes Jumpstart your store’s design with a professionally designed theme.

- Powerful store design tools Powerful store design tools Fine-tune your store’s design with on-brand styles and drag and drop layout editing.

- Unlimited products Unlimited products Grow your store as big as you want with the ability to add unlimited products and services.

- Display products by brand Display products by brand Create, assign and list brands for products, and allow customers to view by brand.

- Product add-ons Product add-ons Increase your revenue with add-ons like gift wrapping or personalizations like engraving.

- Assembled products and kits Assembled products and kits Give customers the freedom to build their own products utilizing your existing items.

- Min/max order quantities Min/max order quantities Specify the minimum and maximum allowed product quantities for orders.

- Back-in-stock notifications Back-in-stock notifications Automatically notify customers when your products are restocked.

- Dynamic product upsells Dynamic product upsells Earn more revenue with automated upsell and cross-sell product recommendations.

- Custom marketing automation Custom marketing automation Advanced email marketing functionality, including subscriber segmentation, advanced analytics, and automation.

- Offer bulk discounts Offer bulk discounts Offer personalized packages and bulk discounts.

- Inventory management Inventory management Keep inventory up-to-date with POS integrations and real-time tracking.

- Streamlined, extendable checkout Streamlined, extendable checkout Remove the friction from checkout by giving your customers multiple ways to pay.

- Sell in 60+ countries Sell in 60+ countries Grow globally by accepting 135+ currencies.

- Integrations with top shipping carriers Integrations with top shipping carriers Get real-time shipping prices, print labels and give your customers tracking codes.

- 0% transaction fee for payments (+ standard processing fee) 0% transaction fee for payments (+ standard processing fee) Credit card fees are applied in addition to commission fees for payments.

- Security, performance, and growth tools—powered by Jetpack.

Storage

Cloud

- High Performance WordPress

- Up to 150 vCPU Up to 150 vCPU

- Up to 225 GB SSD storage Up to 225 GB SSD storage

- 24/7 priority support 24/7 priority support Fast, friendly, expert WordPress help, whenever you need it.

- Install plugins and themes Install plugins and themes Unlock access to 50,000+ plugins, design templates, and integrations.

- Unrestricted bandwidth Unrestricted bandwidth Never fret about getting too much traffic or paying overage charges.

- Global edge caching Global edge caching Ensure your cached content is always served from the data center closest to your site visitor.

- High-burst capacity High-burst capacity Lean on integrated resource management and instant scaling.

- Web application firewall (WAF) Web application firewall (WAF) Block out malicious activity like SQL injection and XSS attacks.

- Global CDN with 28+ locations Global CDN with 28+ locations Rely on ultra-fast site speeds, just about anywhere on Earth.

- High-frequency CPUs High-frequency CPUs Get the extra site performance of high-frequency CPUs, as standard.

- Automated datacenter failover Automated datacenter failover Count on your site being replicated in real-time to a second data center.

- Isolated site infrastructure Isolated site infrastructure Rest easy knowing that your site is isolated from others for added security and performance.

- Managed malware protection Managed malware protection Stay safe with automated malware scanning and one-click fixes.

- DDoS protection and mitigation DDoS protection and mitigation Breeze past DDoS attacks thanks to real time monitoring and mitigation.

- SFTP/SSH, WP-CLI, Git tools SFTP/SSH, WP-CLI, Git tools Use familiar developer tools to manage and deploy your site.

- Free staging site Free staging site Test product and design changes in a staging site.

- Automated WordPress updates Automated WordPress updates Get every WordPress update. And every patch. Automatically.

- Centralized site management Centralized site management Seamlessly switch between 2, 20, or 200 sites. All from one place.

- Real-time backups Real-time backups Count on multi-redundancy, real-time backups of all your data.

- One-click restores One-click restores Revert back to a point-in-time in your site’s history, with a single click.

- Uptime monitor Uptime monitor Stay up-to-date with continuous uptime monitoring, with alerts the minute downtime is detected.

- Plugin auto-updates Plugin auto-updates Forget about time-consuming plugin updates and update nags.

- Yoast SEO Free Yoast SEO Free Rank well in search with built-in search engine optimization tools.

- Security, performance, and growth tools—powered by Jetpack.

Enterprise

- Security, performance, and growth tools—powered by Jetpack.

WordPress to the <Core>